Unparalleled Coverage

Stockpulse provides inimitable decision support for your operations through Artificial Intelligence that collects, filters, matches, scores, and augments unstructured data and converts it into processable information — making Stockpulse a true pioneer in financial news and social media analytics since 2011.

We have one of the most extensive and diversified coverage of financial media sources around the globe. We cover all important social media sources, message boards, traditional and ad-hoc news, company filings, and many more document and media types where users generate content.

Our crawlers have been running 24/7 for over 13 years, building a collection of unique historical data which is one of the longest in this field.

6M+

Messages Daily

200M+

Diversified Sources

13 Years+

Histroical Data

10B+

Total Messages Collected

66k+

Equities Globally

17k+

Cryptocurrencies

20+

Regions

300+

Key Events

Learn more about the Stockpulse method

We improve and support data-driven, quantitative decision making for a broad range of participants in the financial markets by collecting, analyzing, and connecting alternative data from worldwide online sources with artificial intelligence and machine learning.

We Produce Superior Data and Deliver High Quality Analytics

for Many Sectors

Asset Management

Quantitative Asset Management

Stockpulse’s AI is the next level of alternative investing. Enhance your alpha by using Artificial Intelligence and Deep Learning methods, all based on sentiment analysis to tap into the collective user activity on social media.

Brokers

Brokers & Trading Platforms

Gain more interaction with existing customers and intrigue potential clients to join your universal trading platforms by integrating social media and AI signals.

Trading Surveillance

Banks, Exchanges & Regulators

Modern AI and analytic tools for trading surveillance officers and regulators to uncover modern pump and dump schemes and other unlawful market activities on social media and other web-based communication channels.

Crypto Surveillance

Cryptocurrency Markets

Whether it is innovating your product portfolio, enhancing your trading platform, or asset management, Stockpulse’s capabilities offer you the best you can get when it comes to AI and understanding social media.

Cyber Intelligence

Intelligence & Federal Agencies

Highly customizable project development based on your preferences that offer you 24/7 and real-time web monitoring.

PE & Family Offices

Private Equity & Venture Capital

Save time and money and improve your abilities to find the next best investment for your future success.

Investor Relations

Reputation Management

Stockpulse data presents you with the whole picture, accessible in real-time and on demand. The ideal way to monitor perception, proactively seize opportunities or even boost your reputation.

Use our Datasets for Large Language Model (LLM) training

Welcome to the forefront of AI innovation, where the convergence of social media and language model training is reshaping the landscape of natural language understanding. At our cutting-edge platform, we’re pioneering the use of diverse social media sources—including Reddit, Twitter, Discord, TikTok, Telegram, and more—as invaluable datasets for training next-generation Language Models (LLMs).

Imagine tapping into the collective consciousness of millions, even billions, of individuals who freely express their thoughts, opinions, and emotions across these platforms every day. This wealth of unfiltered, real-time data provides an unparalleled opportunity to not only understand human language but also to capture the nuances of sentiment, context, and cultural trends that shape communication in the digital age.

Evaluating the Data

Data collectors are continuously scanning myriads of different internet sources for relevant financial topics, communication, and other unstructured data. Latest Artificial Intelligence and Machine Learning methodologies are used to process and aggravate data quality and extract cryptic knowledge of raw and unstructured data sets into viable and comprehensible information.

Voices of Clients and Partners

Stockpulse’s social media surveillance capabilities are entrusted by the most prestigious organizations

Trading Surveillance Office (TSO) of the Frankfurt Stock Exchange and Eurex Germany relies on data from Stockpulse for Social Media monitoring

Emotional Data Intelligence increasingly important for the stock market and regulatory environment First trading surveillance office worldwide with access to Stockpulse data services Both parties agree on long-term cooperation and expansion of the process chain Frankfurt am Main/Bonn, October 8th, 2019. The Trading Surveillance Office (TSO) of the Frankfurt Stock Exchange and Eurex Germany have … Continue reading

How does Social Media influence Financial Markets? Nasdaq is deploying Emotional Data Intelligence by StockPulse to find out

The original article can be found on the Nasdaq webpage: https://www.nasdaq.com/articles/how-does-social-media-influence-financial-markets-2019-10-14 Stefan Nann is co-founder and CEO of data analytics company StockPulse, a data analytics company specializing in mining Emotional Data Intelligence. “Facts only account for 10% of the reactions on the stock market; everything else is psychology.” André Kostolany, a stock market investor who made most of … Continue reading

Stockpulse gets sponsorship by Bundesministerium für Bildung und Forschung (BMBF, German Federal Ministry of Education and Research) to detect Fake News

Federal Ministry of Education and Research (BMBF) funds project as part of the German government’s National Strategy for Artificial Intelligence (AI) and the High-Tech Strategy 2025 Development of AI software to automatically detect fake news related to financial markets in real time Bonn/Cologne/Berlin, October 01, 2021. From October 2021 onwards, Bonn based Big Data pioneer … Continue reading

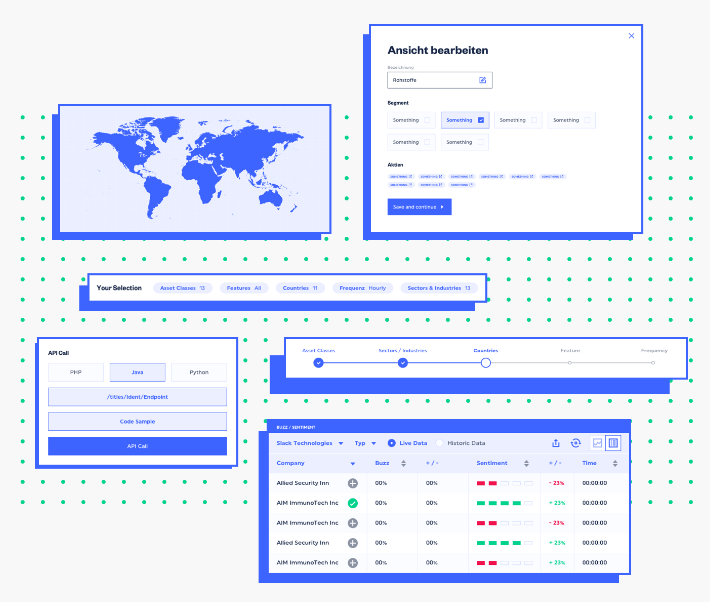

See Our Products in Action

We allocate our solutions in real-time and provide relevant market input customized to your specific needs. Get in touch with us and apply for a free trial.